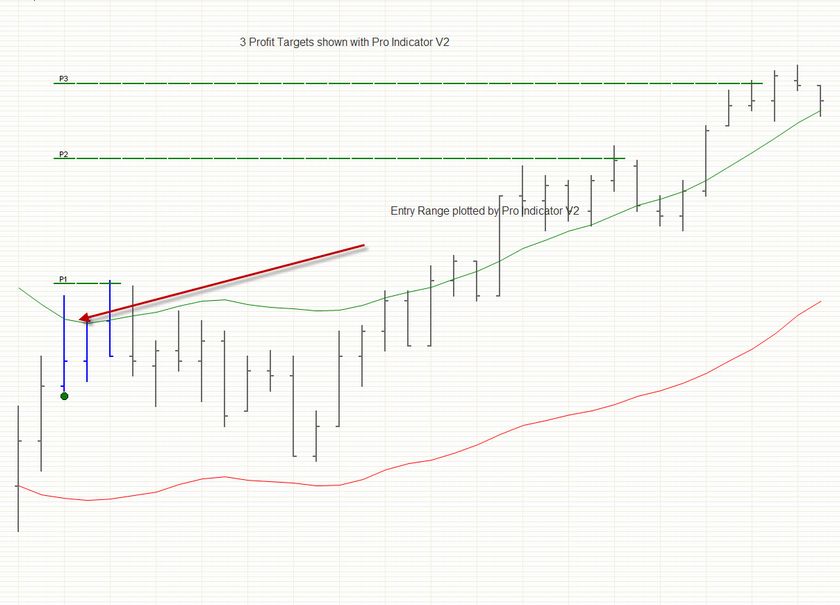

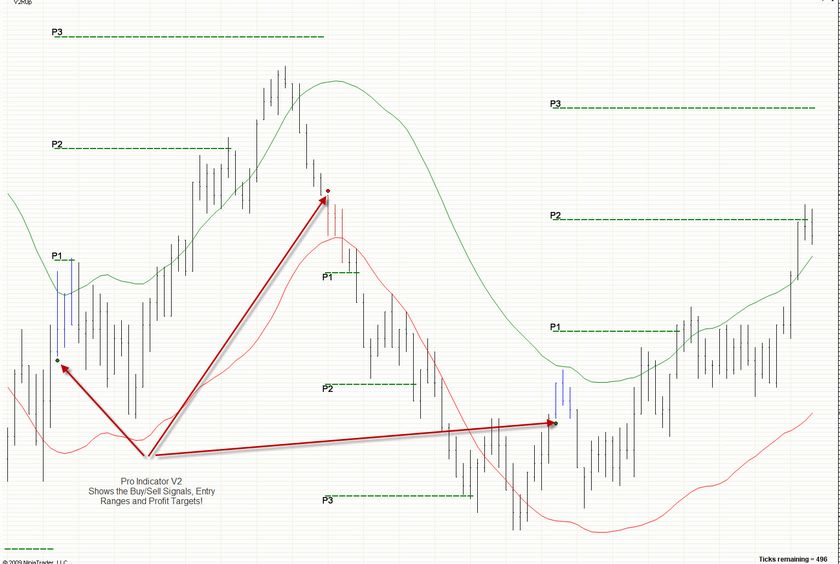

The Dow emini market moves a lot slower than the S&P 500 Emini Market. Accordingly, you will not get as many trades with the dow trading system as you would my emini S&P system. Generally I like to be finished day trading within the first 30 to 60 minutes of the day. 1 point per day ($50) per contract is all I need to make a nice, steady daily income!

However the Dow emini strategy really takes day trading to the next level. The Dow Emini Market moves and trends a lot longer, potentially allowing the day trader to conceivably achieve 20 to 60+ ticks a day! That's $100 to $300 just on one contract!

This brings me to my Advanced Training Video Series where I trade both systems combined.

Our Advanced Training Video Series is included with the Dow Emini Trading System as it illustrates trading both systems. You will see us trade both markets for $100 to $300 profit per day using both strategies. These advanced videos were recorded using a live trading account so you can learn and see the action in a real market environment!

These videos are meant to be used for an advanced student and we must insist that you first learn our Tick Trader Methods before ever attempting to use what we teach in the Advanced Videos.

Having said that, our Dow Emini Trading System is pretty easy to learn. Although it does have strict rules, it does not have the strictness of our S&P emini system. This makes it an ideal market for a newer trader to learn from. The advanced concept surrounds trading both the S&P Emini and the Dow Emini markets simultaneously, and therefore requires you to learn the S&P Emini Trading System as it's been performing and delivering for years.

It is, however, a little easier for a beginner to learn day trading on the Dow Emini Market while still learning the rest of the system. Of course, you should always sim-trade for several weeks before you ever trade with real money. Please read our disclaimers at the bottom of this page.

You must be a Tick Trader Day Trading System course owner to purchase The Dow Emini System / Advanced Training Videos. You have the option of purchasing the Dow Strategy add-on at checkout.

DISCLAIMER: Futures and options trading involves substantial risk of loss and is not suitable for every investor. The valuation of futures and options may fluctuate, and, as a result, clients may lose more than their original investment. The impact of seasonal and geopolitical events is already factored into market prices. The highly leveraged nature of futures trading means that small market movements will have a great impact on your trading account and this can work against you, leading to large losses or can work for you, leading to large gains. If the market moves against you, you may sustain a total loss greater than the amount you deposited into your account.

You are responsible for all the risks and financial resources you use and for the chosen trading system. You should not engage in trading unless you fully understand the nature of the transactions you are entering into and the extent of your exposure to loss. If you do not fully understand these risks you must seek independent advice from your financial advisor. All trading strategies are used at your own risk. This software should not be relied upon as advice or construed as providing recommendations of any kind. It is your responsibility to confirm and decide which trades to make. Trade only with risk capital; that is, trade with money that, if lost, will not adversely impact your lifestyle and your ability to meet your financial obligations.

Past results are no indication of future performance.

In no event should the content of this correspondence be construed as an express or implied promise, guarantee or implication from Insight One LLC that you will profit or that losses can or will be limited in any manner whatsoever. Insight One LLC is not responsible for any losses incurred as a result of using any of our trading strategies and software. The AutoTrader should never be left unattended due to the possibility of events out of your control, such as computer or data failure, power outages, position mismatches, and/or network problems. Loss-limiting strategies such as stop loss orders may not be effective because market conditions or technological issues may make it impossible to execute such orders. Likewise, strategies using combinations of options and/or futures positions such as "spread" or "straddle" trades may be just as risky as simple long and short positions. Information provided in this correspondence is intended solely for informational purposes and is obtained from sources believed to be reliable. Information is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted.

Live Trade Room: Any and all live presentations are for educational purposes only and the opinions expressed are those of the presenter only. All trades presented should be considered hypothetical and should not be expected to be replicated in a live trading account.